Summary: Businesses face many risks during the summer from employee heat stress to possible storm damage. Along with these risks, 2020 has challenged us all with the COVID-19 pandemic. Learn how to keep employees and property safe from summer safety risks in AmTrust’s new guide, 2020 Summer Risks for Business: Keeping Your Employees and Property Safe. COVID-19: Extra Risks for Businesses This Summer

The unique risks summer brings – soaring temperatures, busier travel schedules and strong storms – are now combined with the risks presented by the coronavirus pandemic. Employers should take extra precautions to keep their business and their employees safe in Summer 2020.

Summer Business Travel

Staying safe and healthy should remain top of mind for anyone with

plans to travel from their local community in the next few months.

What About Employees and Personal Travel?

Extra measures should be taken to ensure the health and safety of the entire workforce before they may return to the workplace, such as implementing a policy that requires the employee to self-quarantine for 14 days.

Working in Summer Heat

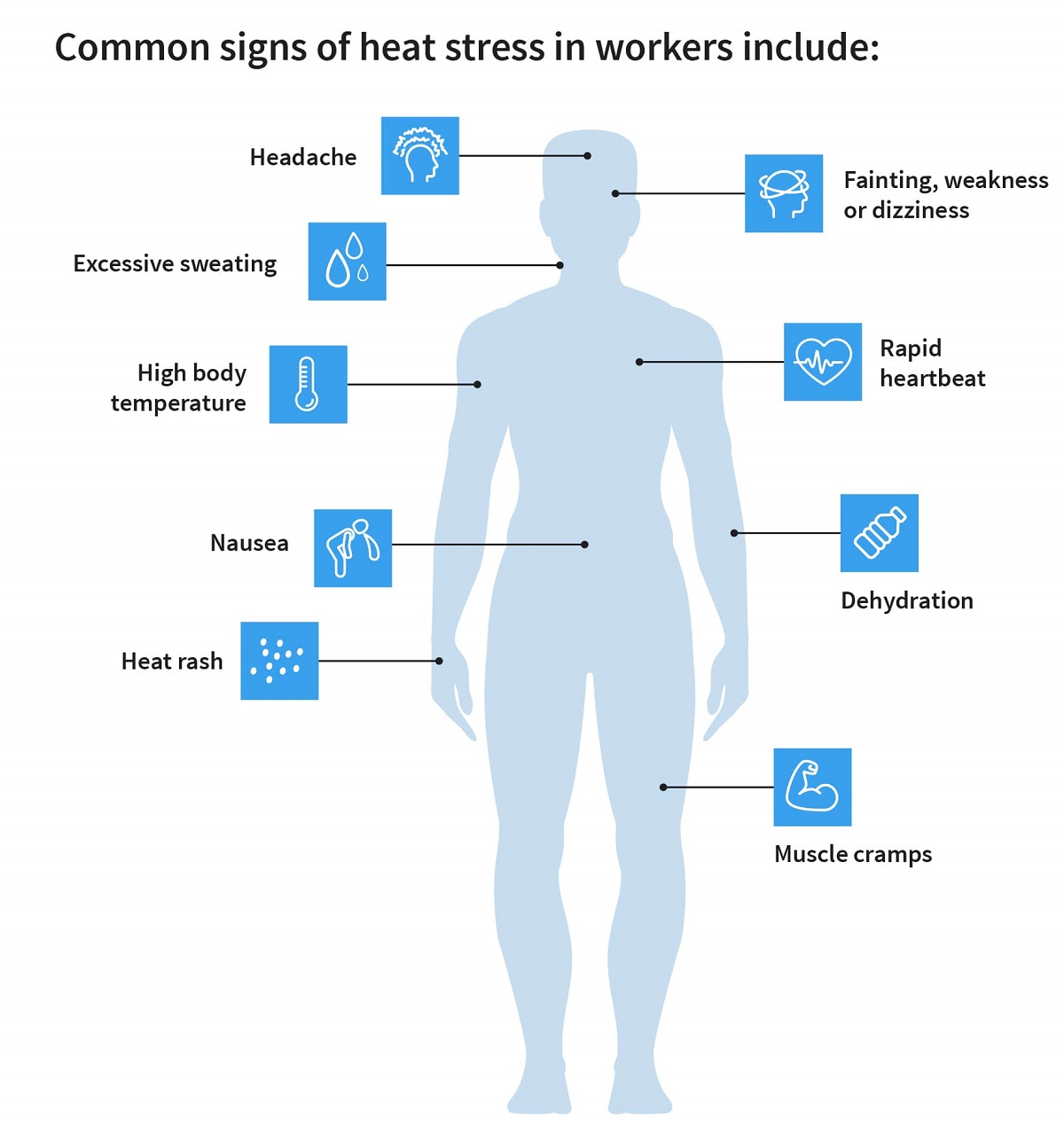

Outdoor workers and workers in non-conditioned spaces in a variety of industries are often

exposed to extreme heat and/or humidity that can easily lead to heat stress and exhaustion, heat stroke and even death.

Heat stress begins when high temperatures and/or humidity cause workers’ bodies’ natural cooling mechanisms to become ineffective, and the body core temperature begins to rise.

Thousands of workers nationwide can suffer heat-related illnesses every year. However, the good news is that these conditions can be avoided when the proper preventative steps are taken. These include:

For new workers, exposure to heat should be around 20% on day one, increasing another 20% with each passing day on the job.

COVID-19 Impact

Many businesses require cloth face coverings at the workplace to help reduce the spread of COVID-19. It’s important that business owners keep the environment employees are in top of mind, as face masks can pose potential hazards like heat stress when worn in warm, humid conditions.

A face mask should not replace six-foot physical distancing, respiratory etiquette, and frequent hand washing. Additionally, improper use can lessen their protective benefits or even introduce

new or unanticipated hazards into the business operation that could potentially lead to a workers’ compensation claim.

Delivery Risk: Your Order is on its Way

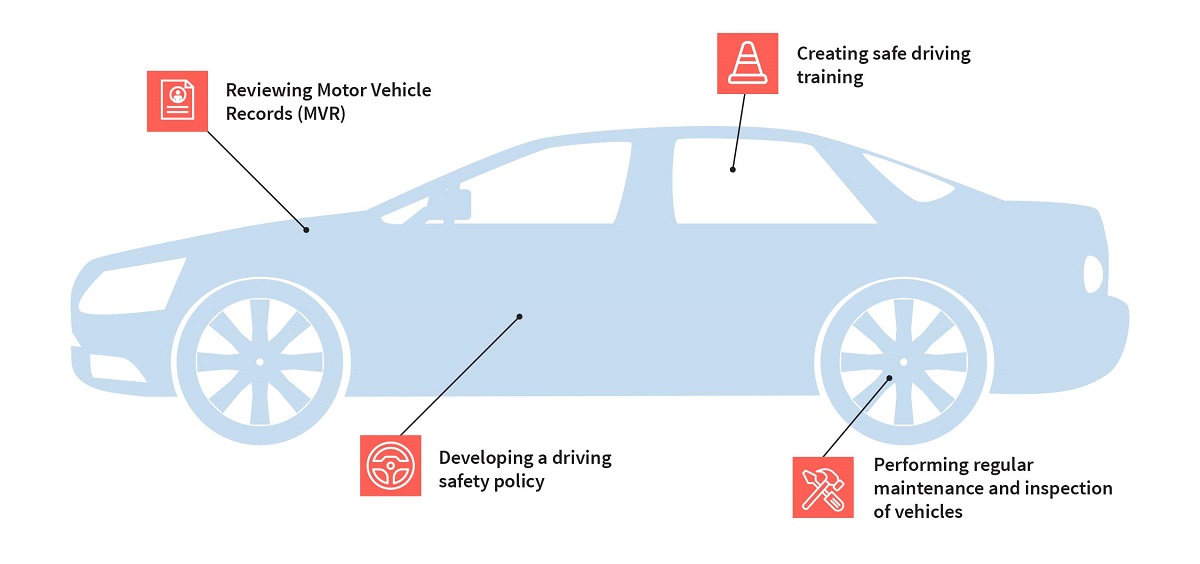

As more restaurants add delivery, restaurants should focus on motor vehicle risk.

AmTrust anticipates motor vehicle claims will continue to become more common in this sector as delivery is taking on an even bigger role during the coronavirus pandemic. Before COVID-19 hit, the impact of motor vehicle accidents was already on our radar, as motor vehicle accidents account for some of the more costly claims for restaurant classes. Restaurant owners should follow driving safety best practices including:

Restaurant motor vehicle accidents are consistently almost double the cost of slip and fall accidents.

Summer Restaurant Industry Risks

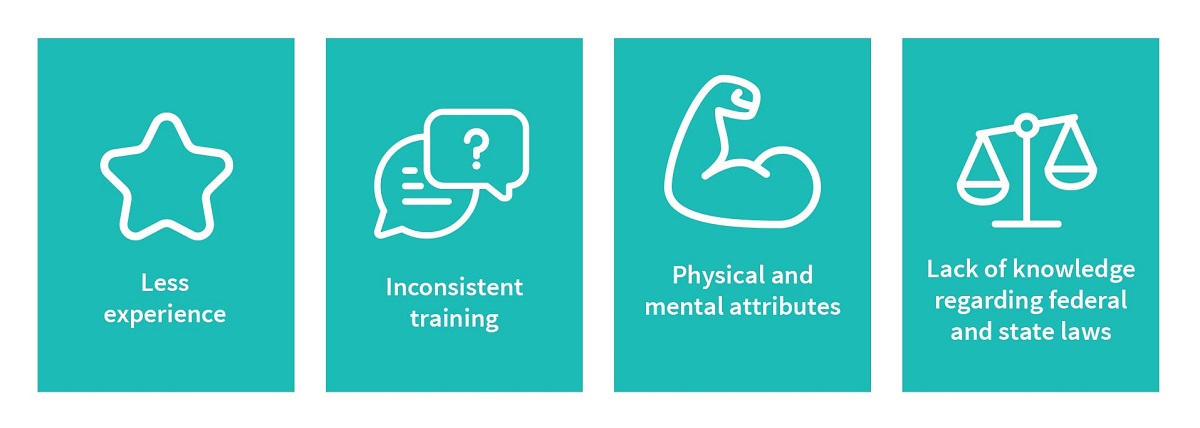

Summer normally is the busiest time of year for restaurants, making it necessary for owners and managers to hire temporary staff to compensate for the additional business. According to the

AmTrust Restaurant Risk Report, June, July and August historically have the highest reported restaurant workers’ compensation accidents.

Inexperienced and/or newly hired seasonal workers are more likely to be injured than those who have been on the job for a while due to:

AmTrust data shows that July experiences 12% more workers’ compensation claims than the rest of the year.

Cuts make up a third of restaurant claims reported, but slip and falls accounts for 4.5 times more in paid losses.

COVID-19 Impact

“In the wake of COVID-19, worker safety has taken on a new meaning. It is well understood that slips and falls, cuts and burns, strains and sprains are part of the restaurant business. But now restaurant owners and managers are faced with a new dilemma: protecting employees and guests from the spread of a virus.” – Matt Zender, SVP Workers’ Compensation Strategy at AmTrust

Summer Risks for Other Industries

Summer of 2020 presents unique challenges to all industry. Here’s how a few industry will be impacted.

Retail Summer Risks

AmTrust’s Retail Risk Report shows that strains are the most common injury payout for retail workers, but slips and falls resulted in higher payouts. Retail stores should continue to train employees on safety, while remembering that during the COVID-19 pandemic it is even more important for workers to pay attention to their surroundings and stay hydrated.

Manufacturing Summer Risks

Higher indoor temperatures can lead to challenging working conditions. Workers should wear lighter clothing and stay hydrated. Due to COVID-19, manufacturers have to create safe environments for their workers including advocating social distancing, wearing cloth masks and provide handwashing stations.

Office Summer Risks

An office setting poses certain risks employees throughout the year including injuries caused by machinery, slips and falls or fire hazards. During the coronavirus pandemic, creating safer office workplaces for employees to return to is vitally important.

Offices should follow state regulations on occupancy levels and implement social distancing recommendations, proper hand hygiene and other precautionary measures.

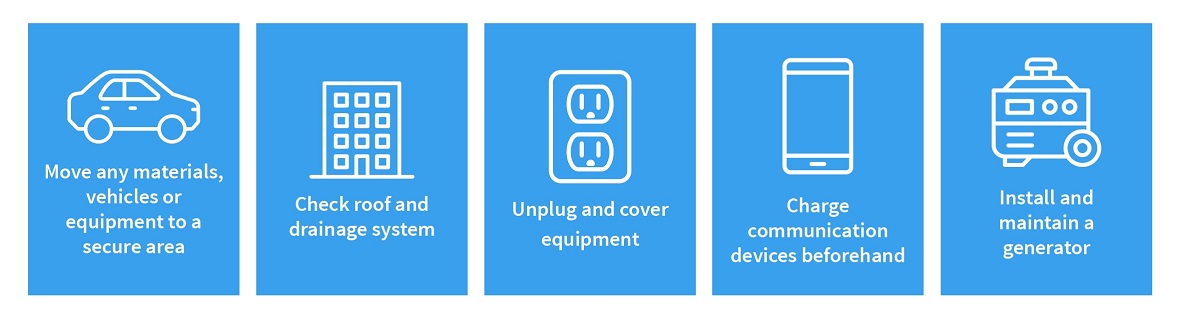

Summer Storm Preparedness

Businesses need to proactively

create a plan to help them prepare for the severe storms summer can bring.

Protect Your Most Important Asset: Your Employees

Small businesses that could be in the path of these storms should create a

hurricane preparedness plan for potentially extreme weather conditions.

- Verify employee contact information

- Update critical business functions

- Prepare your recovery location

For all storms, close your office at a time that allows your employees ample opportunity to safely travel home, so that they can secure their home and prepare for the storm.

What to Do After the Storm

After the storm has passed, the first thing to do is to make sure that everyone is safe. Once it is possible to emerge from the safe spot, follow these steps:

- Take pictures of damage

- Keep clear of heavily damaged areas until crews arrive

- When safe to do so, disconnect all affected electronics and electrical equipment and move it to a dry location

- Stay at least 10 feet from downed power lines

- Protect your property from further damage by boarding up windows and salvaging undamaged items

- Contact your insurance agent and file a claim as soon as it is safe to do so

COVID-19 Impact

“If a natural disaster were to hit a coronavirus hot zone area there are concerns this could quickly devolve into a situation we’ve never seen before with devastating social, safety and economic impact. This includes before, during and after the storm. We are in uncharted waters. The large increase in COVID-19 cases in Florida and other gulf coast states as we approach the middle of the hurricane season is a legitimate cause for concern. This year more so than any other year in our lifetimes, developing a hurricane plan is something you have to do.” –Jeff Corder, VP Loss Control at AmTrust

AmTrust Helps Small Businesses

AmTrust’s 2020 Summer Risks for Businesses guide shares strategies and tips to keep your insureds healthy and safe this summer from extreme heat, strong storms, COVID-19 and other risks.

We also have a dedicated

coronavirus resource center to help our appointed agents and small business insured stay informed, safe and healthy throughout these difficult times. For more information on our

small business insurance solutions, please

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.