Summary: In part one of our in-depth Workers’ Compensation series, we discussed the basics of workers’ compensation insurance, why small businesses need it, how much it costs and much more. In the second part of the series, we’ll take a deeper dive into industry trends and what factors affect workers’ comp, return to work programs and the role workplace safety can play in reducing injuries and accidents. Industry Outlook, Challenges & Trends Affecting Workers’ Comp

Workers’ Compensation Industry Outlook

Every year, different factors influence the workers’ compensation market. From politics and new technology to a global pandemic and a growing gig economy, workers’ comp rates and policies will continue to evolve as time goes on.

Insurance experts and the

National Council on Compensation Insurance (NCCI) predict the workers’ compensation system will

remain strong and resilient despite the uncertainties brought by the COVID-19 pandemic in 2020 and early 2021. The COVID-19 losses to the industry were much lower than initially expected, and although net written premium decreased by 10% in 2020, other financial metrics such as operating margins and the industry reserve position remain favorable – some even at all-time highs.

What’s ahead for the

workers’ compensation industry? Creating safer workplaces, advances in telehealth and technologies, ongoing state regulatory reform, and dealing with the lasting effects of COVID-19 will remain top of mind for the near future.

Challenges Facing the Workers’ Compensation Industry

Over the last few years, the workers’ compensation industry has continually evolved, although some may argue at a slower pace than other industries. Here’s a closer look at some of the

top challenges ahead for the workers’ comp industry:

- Changing workplace demographics: Young, inexperienced workers entering the workforce, the aging population facing retirement, and a greater number of people working from home are all factors that can affect the workers’ comp system. Plus, more workers are shifting to contract or gig work.

- Mental health exposures: Studies have shown that following a work-related injury that results in chronic pain, many individuals suffer from depression, which plays a major role in slowing the recovery process and delaying the return to work.

- Complex claims: An increase in mental health concerns, as discussed above, will also have an impact on the complexity of workers’ compensation claims, and while most claims don’t start as complex, they can become more complex due to several factors, such as attorney involvement.

- New and expensive or “mega” claims: Catastrophic injury claims can reach around $10 to $15 million (sometimes called “mega claims”), with industry data indicating that the amount of claims topping $5 million incurred continues to rise.

- The opioid epidemic: An employer’s workers’ compensation program should address the opioid crisis directly to help reduce the risk of abuse and the cycle of addiction. In many cases, there could be safer treatment alternatives to opioids to consider.

- Rising prescription costs: Prescription drugs account for approximately 14% of a workers’ compensation claim on average.

- Medical marijuana: Maintaining a drug-free workplace and ensuring the safety of all employees will continue to be a major concern as more individuals may be prescribed medical marijuana in the coming year.

- Comorbidities: Conditions such as obesity, diabetes, tobacco use, substance abuse and mental health issues can lead to workers’ compensation claims with a longer duration, higher costs, more temporary disability days and increased litigation rates.

- Regulatory or legislative changes: Since insurance commissioners have a large impact on workers’ compensation policies, changes could be coming to states across the country.

- Data security and privacy laws: The new data privacy laws are both a challenge and an opportunity for the insurance industry and are an issue to watch closely for the future. As the insurance industry adapts to modern technologies like artificial intelligence (AI) for more efficient claims and underwriting processes, for example, or leveraging chatbots to address employee questions as quickly as possible, data security continues to be a bigger consideration.

Other Factors that Affect Workers’ Compensation

The Correlation Between Hiring Procedures and Workers’ Compensation Claims

To help mitigate the risks for workplace accidents, small business owners need to have a solid plan for

recruiting, hiring and training workers. The Bureau of Labor Statistics found that nearly

40% of injured workers have been on the job for less than a year. New workers are more likely to be hurt because they lack the experience and information needed to properly protect themselves while performing their job duties. Having solid training plans in place for new hires can help mitigate some of the risks.

High Deductible Health Care Plans and Workers’ Comp Claims

One thing employers may not consider when seeing a rise in their workers’ compensation claims is their company’s

high-deductible health plan (HDHP). An HDHP is a health insurance plan that features a deductible of at least $1,350 for an individual or $2,750 for a family. That amount is what your employees pay out-of-pocket for any medical expenses before insurance takes care of the rest. In other words, this is the most amount your employees will pay in a year for medical expenses covered by the health insurance plan.

If your company offers an HDHP, that means your employees pay more out-of-pocket when receiving health care. To avoid paying the large expenses, injured workers are more apt to file a workers’ comp claim, where there are no deductibles or copayments for their medical care, rather than use their own health care coverage.

A r

eport from the Workers’ Compensation Research Institute found that injured employees are about 1.4% more likely to file a workers’ comp claim if the remaining health insurance plan deductible is $550 or higher, as opposed to no deductible at the time of injury.

Preexisting Conditions and Workers’ Compensation

Some employees may not realize the importance of disclosing a preexisting injury or medical condition when filing a workers’ compensation claim.

When an employee is clear and upfront about a

preexisting condition, both the employer and employee stand to benefit. The employee receives the best possible treatment and equitable compensation, while the employer is more likely to have the employee back and contributing to the organization sooner.

In most states, an injured worker is eligible for workers’ comp benefits when a work-related injury exacerbates a preexisting injury or condition – or leads to another condition.

Generally, if a previous work-related injury caused the preexisting condition for which the employee receives workers’ compensation, the employee would qualify for additional workers’ compensation. The key is that the injury must have aggravated the condition – even if the preexisting condition was not work-related.

The Affect the Time of Year has on Workers’ Compensation

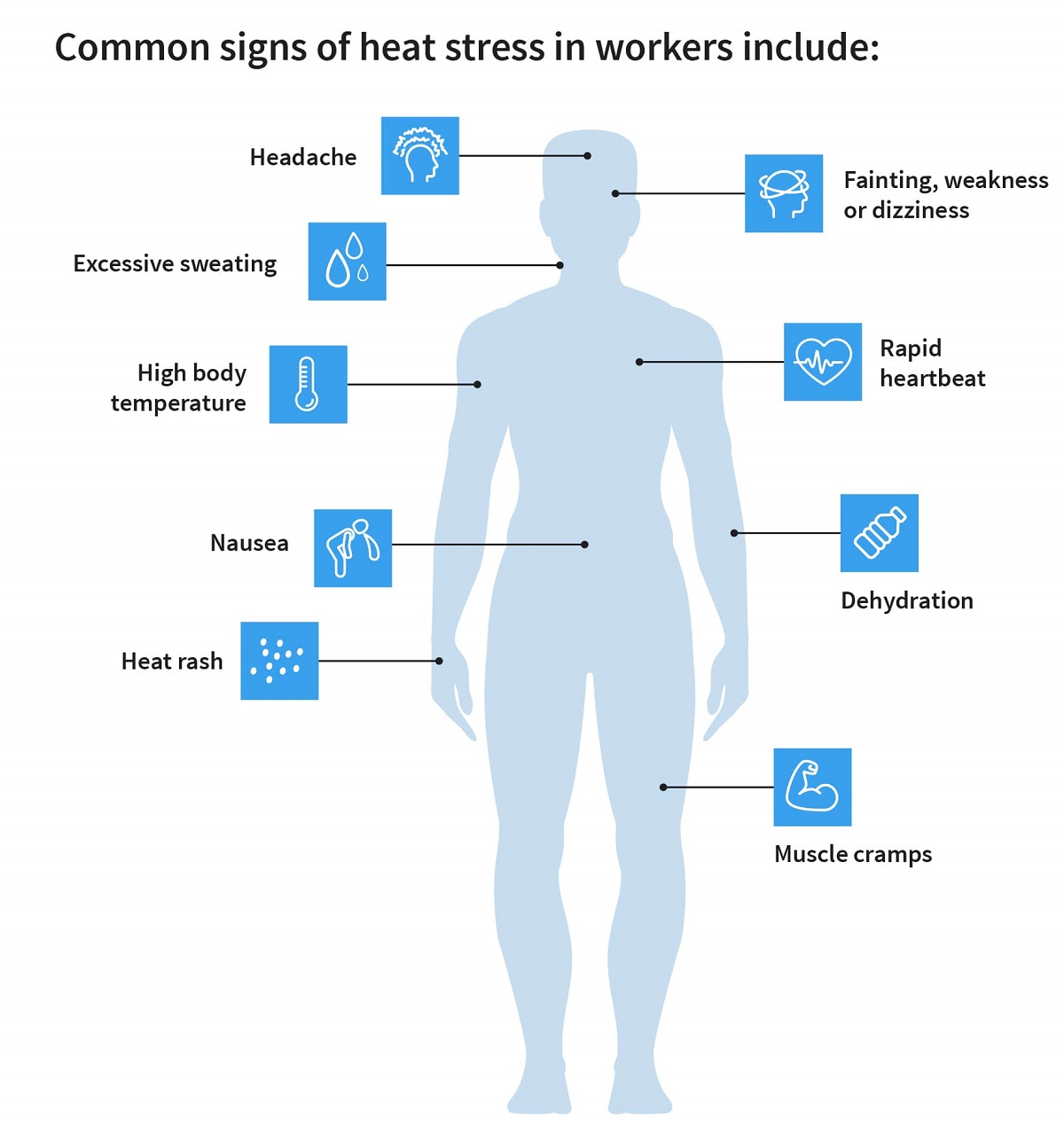

Summer Heat Outdoor workers and those who work in non-air-conditioned spaces are often at risk for various

heat-related illnesses, like heat stress and heat exhaustion.

Employers must provide proper training to employees and supervisors to ensure they understand the dangers of heat-related illnesses and how they can impact their overall health and safety.

Cold Winter Temperatures Understanding the risks

employees working in cold weather face can be critical to avoiding injuries and illnesses throughout the winter. Similar to employees who work outdoors during the summer months, workers in various industries, such as construction or utility workers and first responders, all can face common

winter weather hazards, including:

- Cold stress illnesses like frostbite and hypothermia

- Muscle strains, sprains and fractures from slips and falls on icy sidewalks or slick entryways

- Driving in inclement weather conditions

- Snow shoveling or snow blowing injuries

- Working on rooftops

Daylight Savings Time and Sleep Deprivation

Daylight Saving Time (DST), popularly known as Daylight Savings Time, is the practice of setting the clocks forward one hour from standard time during the summer months and back again in the fall to make better use of the natural daylight.

Sleep deprivation from daylight saving time changes can impact a worker’s productivity for up to a week after we spring forward or fall back.

Lack of sleep causes fatigue and can affect an employee in a multitude of ways:

- Impairs the ability to make decisions quickly and clearly

- Decreases concentration, causing the mind to wander or cause the worker to just “go through the motions” rather than sharply focusing on the task at hand

- Decreases effort-level and production

- Causes physical ailments such as irritability, drowsiness and muscle pain

Be sure to communicate to your workforce not only the importance of getting enough sleep but the dangers of working while suffering from fatigue.

The Psychology of Pain

Pain treatment is highly personalized to the individual’s specific needs. However, due to what’s known as the

psychology of pain, the perception of pain, especially the perception of chronic pain, can intensify when adding in psychological, social and emotional factors. Studies show that the more individuals focus on the pain, the worse it tends to become.

Studies have also shown that following a work-related injury that results in chronic pain, many individuals suffer from depression. When combined with the physical injury, depression plays a major role in slowing the recovery process and delaying the return to work. Plus, it’s common for these individuals to be prescribed opioids at higher doses. This makes diagnosing and treating the psychological effects of the injury as important as treating the physical pain. Healthcare providers and workers’ comp carriers should be prepared to offer the maximum support the individual needs to recover.

The difficulty lies in identifying the workers who need this psychological support. Looking for symptoms like personality changes, how invested the individual is in the recovery process and returning to work, and the worker’s dependency on medications can reveal psychological components that need to be addressed. If left untreated, they can contribute not only to the employer’s disability claims but to a loss in productivity and a boost in employee absences.

Driving Records and MVR Checks

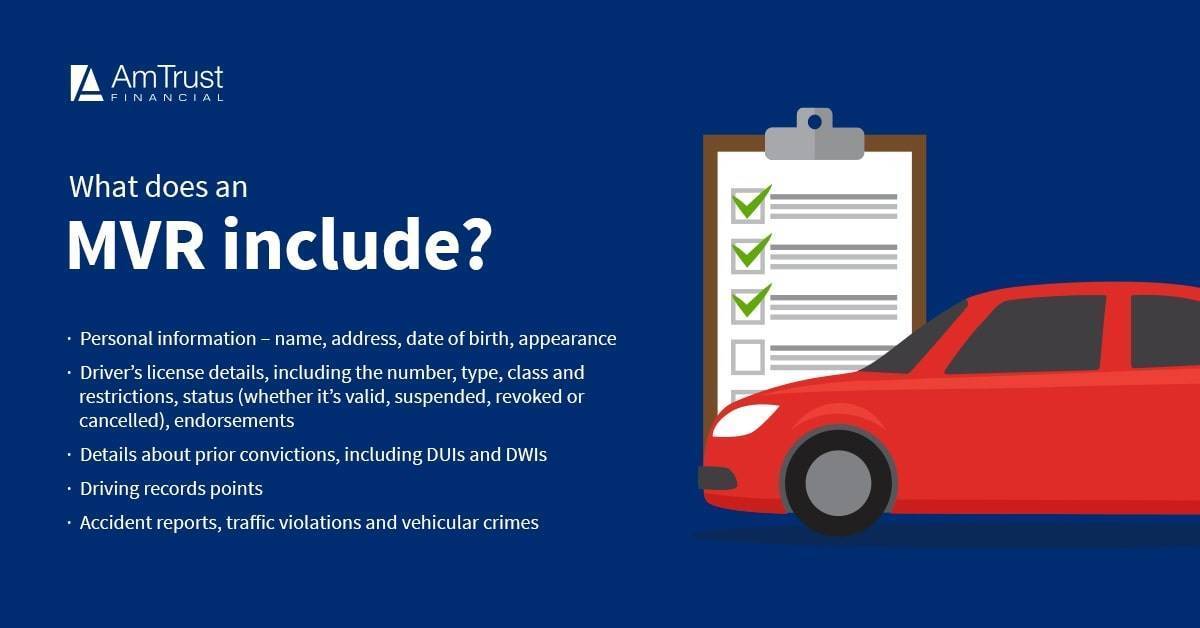

Fundamentally,

motor vehicle record checks (MVRs) are a tool to help ensure that a business puts only qualified, safe drivers into its vehicles. Or, equally important, the organization only permits safe drivers to use their own vehicles on company business. It is a well-established law that while an employee is conducting company business in their personal vehicle, in the event of a mishap, the company’s workers’ compensation and potentially other liabilities can come into play, adversely affecting the business.

An MVR provides information not always found in a standard employment screening test, like a criminal background check. The type of information you can expect to learn from an

MVR includes:

An annual MVR screening can help:

- Predict an employee’s future driving habits

- Establish ratios of how many violations are typically committed before being observed by a police officer and cited

- Give employers important driving information about their employees

- Verify new employees’ are pre-qualified as alternate fill-in drivers as needed

- Determine driver competency and safety to avoid negligent entrustment charges

Return to Work Programs

Benefits of a Return to Work Program

To protect their employees, their profitability and their workers’ compensation claims costs, small business owners can implement a

return to work (RTW) program. These programs are a proactive way to help injured employees return to their full potential on the job as quickly and safely as possible. Return to work programs are an efficient way for employers, employees, healthcare providers and claim administrators to manage the workplace injury rehabilitation process.

A well-planned, well-run

RTW program benefits employees and their employers in a variety of ways. From an employee perspective, the program:

- Frees the injured employee from financial stress. An RTW program enables the recovering employee to begin earning their original wages sooner, providing the employee’s family with invaluable financial security.

- Keeps the recovering employee’s skills sharp. By avoiding a long, stagnant layoff, the employee will retain their skill set.

- Keeps the injured employee socially connected. A relatively short absence from work allows the recovering employee to avoid feeling socially isolated. Plus, the opportunity to be productive gives the employee a sense of purpose.

- Reduces recovery time. An injured employee’s safe and swift reintegration into the workplace, even in a different role, can help hasten the healing process.

- Boosts morale. Knowing the employer has taken the necessary steps to ensure a safe return to work will fuel the recovering employee with optimism, confidence and peace of mind.

By implementing a comprehensive RTW program, a business can:

- Reduce costs. By offering injured employees the opportunity to assume a modified role – when it’s medically feasible – employers can minimize their workers’ compensation costs, including their temporary total disability payments. What’s more, the swift return of an experienced employee will save the employer the cost of training and compensating a temporary replacement.

- Reduce turnover. According to the Bureau of Labor Statistics, there’s only a 50% chance that an injured employee will return to work after a six-month absence. Having a program in place that facilitates an employee’s safe and supportive reentry will only increase the likelihood of the employee’s return. Moreover, the time and expense involved with hiring and training new employees can cut deeply into a company’s profit margin.

- Maintain productivity. An injured employee who returns to work, even in a limited capacity, can still be a valuable contributor. Having the opportunity to be – and feel – productive is what every employee wants.

How to Create a Return to Work Program

Set Expectations Creating a policy that identifies expectations for the organization and employees is key to creating a RTW program that works to assist employees in returning to work from a disability leave when it is medically advisable.

Communicate Internally Once the RTW policy is in place, employers should make sure all management team members understand why it’s beneficial to the bottom line and how to implement it with employees. It’s also a good idea to share the policy with all personnel through internal email, intranet, and/or a newsletter.

Implement Consistently When an employee becomes disabled, it’s time to follow the plan of action outlined within the RTW policy. Consistency in implementation will instill confidence both in the policy and the company for the ill or injured employee, so that they feel important to the company and cared for throughout their recovery.

Maintain Communication Nothing promotes morale more than get well cards and letters from colleagues. Make sure that the injured or ill employee knows the whole team is rooting for them. Not only does this promote confidence in the employee on leave, but it also improves the morale of colleagues who see they will be treated with kindness and respect should they experience a similar situation.

Keeping in touch throughout allows the company to see the employee’s recovery process and progress. This will help the management team plan the next steps for the employee’s return to work – whether it be putting the employee on light duty, a different job, or returning to the original full-time position.

Resolve Claims Once an employee is fully recovered and back at work, the policyholder should work with their agent to close the disability claim as quickly as possible. More open claims mean higher premiums. Closing claims promptly means the company will pay the appropriate premium and not an inflated one.

Workplace Safety

The ROI of Safety

Although the workplace continues to become a safer environment for employees, accidents can still occur and cost a business thousands of dollars every year in medical and other expenses. Workplace injuries and illnesses lower productivity and employee morale, and they also result in increased absences that could ultimately lead to lower profits.

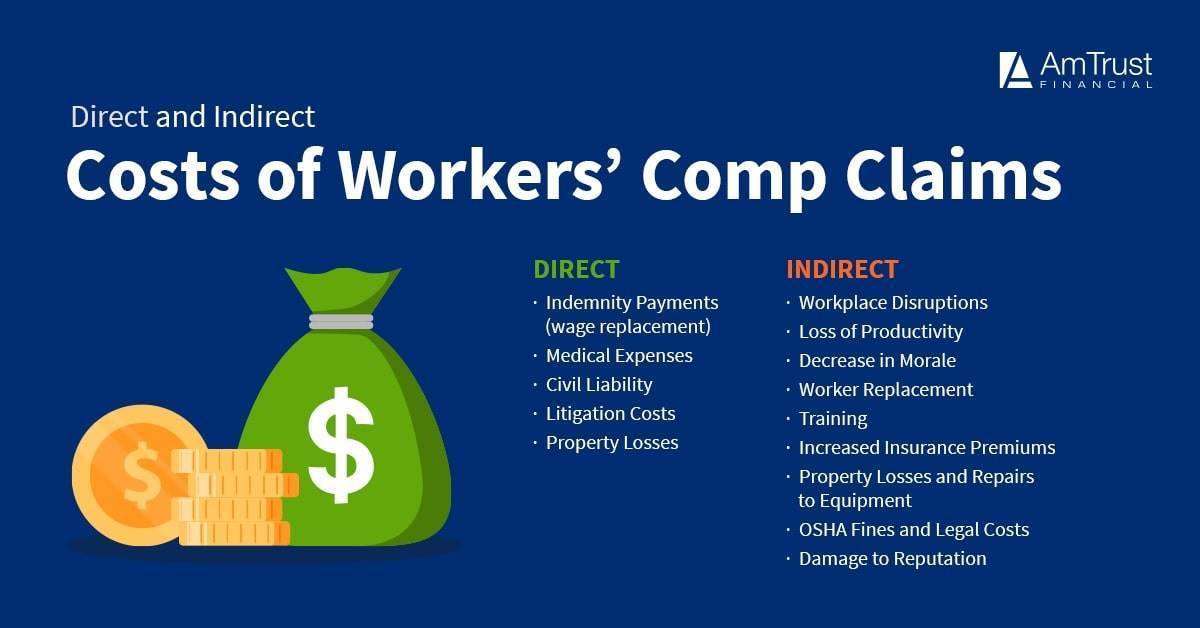

The true

cost of work-related injuries is much more than just the cost of workers’ compensation insurance and medical bills. It impacts the workplace both directly and indirectly.

How to Create a Workplace Safety Program

Effective

employee safety training programs are necessary to eliminate human suffering due to injuries incurred on the job, and they help reduce the direct and indirect costs of accidents. They also provide a means for businesses to comply with state and federal regulatory requirements, reducing the concern over exposure to fines and legal sanctions.

OSHA has provided the

basic components for creating a safety program, which then can be built upon for each organization’s specific needs. A program couldn’t get off the ground without the commitment of management and the involvement of a business’s employees.

A critical step in creating an effective workplace safety program is identifying and assessing current hazards on the premises or job site. Once the potential risks are recognized, companies can create safe working policies to ensure controls are put in place to minimize or eliminate injuries, illnesses or accidents.

Basic elements of a workplace safety program include:

- Management commitment and worker involvement: Management should communicate the program clearly to the workers and involve them in the formation and continuous implementation of the program.

- Worksite analysis: Rigorous self-inspection combined with a visit or informational resources from the company’s insurer, local safety council, OSHA, etc., can help identify hazards.

- Hazard prevention and control: Effective controls protect workers from workplace hazards and help minimize or eliminate injuries, illnesses and accidents.

- Train workers, supervisors and managers: Train everyone in the company at the implementation of the safety program. Include the safety program in new hire training or when an employee’s tasks and potential work hazards change. Establish and stick to a rigorous safety training schedule for the entire staff.

Preventing Workplace Accidents and Injuries

Here are tips for business owners to help their employees avoid five of the most

common workplace injuries:

Overexertion The most common type of overexertion is back strain as a result of lifting heavy objects. Overexertion from repeated work-related activities can also lead to a variety of cumulative trauma disorders, such as tendonitis and carpal tunnel syndrome. When carrying substantial items, keep the load close, bend at the hips, and do not over-reach or twist the body. Additionally, maintaining good physical condition by practicing stretching and conditioning exercises and good posture can help to prevent these injuries.

Falls, Slips or Trips Certain floor surface types, level changes and friction, as well as uneven

walkways or changes in the floor surface or foreign objects, can increase the potential for

falls, slips or trips. It is important to have good visibility, remove obstructions and be aware of your surroundings to reduce the potential for these accidents. Employers should also offer training programs focused on fall prevention and always provide the proper equipment like body harnesses or guardrails to help reduce risk.

Transportation Incidents For employees who operate vehicles, observing traffic laws is important for their safety and others on the road. Other considerations include wearing seatbelts, evaluating weather conditions, training personnel operating specialized vehicles, implementing routine maintenance and not requiring staff to drive at irregular hours. Checking drivers’ motor vehicle reports (MVRs) can also ensure only qualified, safe drivers are getting behind the wheel.

Burns Some industries have considerable exposure to burn risks, including

restaurants, construction, auto mechanics and certain types of manufacturing. Wearing and using protective equipment and maintaining tools can reduce the potential for burn hazards in these industries.

Lacerations With many ways an employee can be cut or punctured by tools, machines, instruments, as well as environmental objects like plants or animals, it is best to focus on general safety precautions such as maintaining equipment and ensuring necessary procedures are implemented and enforced. If employees regularly work with knives, such as in commercial kitchens, proper

knife safety training can help reduce some of the risk these workers face.

Loss Control for the Workplace

Small business owners and commercial insurance companies have this common goal – to prevent claims. Minimizing exposure to avoidable risks resulting in claims doesn’t end with purchasing workers’ compensation insurance and/or business liability insurance.

The goal can be reached when loss control is taken to the next level using industry-specific technical guidance and general safety and training resources. Access to those types of resources and training can help small business owners implement practices focused on preventing avoidable risks.

AmTrust’s

Loss Control Department offers solid training programs and consultation services to help small businesses reduce risk and keep employee safety top of mind at all times.

Workers’ Compensation and Loss Control Services from AmTrust Financial

AmTrust Financial is a leader in

workers’ compensation insurance for small to mid-sized businesses. We love working closely with our agents and small business owners to design the right coverages for their specific needs. Additionally, our Loss Control Department specializes in loss prevention and risk management solutions that improve employee safety. We can help your organization identify specific hazards and provide extensive training to help address them and reduce workplace injuries and accidents.

For more information about our

small business insurance solutions, please

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.