Importance of Motor Vehicle Reports (MVR) Background Checks

Sometimes, when asked about checking

Motor Vehicle Reports (MVRs) on their drivers, small and medium business owners will ask, “Why? I’m not a trucking or a bus company – I don’t really even hire any drivers, I hire plumbers (or carpenters, or sales people, etc.), I don’t have a fleet of big vehicles and professional drivers.”

In contrast to full-time, professional truck and bus drivers, whose primary job is driving, driving duties for plumbers, carpenters, consultants, sales people and many other workers are considered incidental to their primary jobs. In other words, driving is a necessary part of the job, but not the fundamental job. Accordingly, these drivers are called

incidental drivers.

While it’s true that many occupations’ driving requirements do not involve the all-day, every-day driving exposure faced by professional drivers, incidental drivers do face the same road hazards and dangers as the pros. And the fundamental safety controls are pretty much the same.

Federal Law 49 CFR 391.25 and 391.27 state that regulated motor carriers (U.S. Code of Federal Regulations-operations of big trucks and busses) should check their drivers’ MVRs at the time of hire and review MVRs on an annual basis, among other requirements. Do they know something that can be useful to the small incidental fleet (“fleet,” for small business purposes, means one or more vehicles) operator?

The Benefits of MVR Screening Checks

Fundamentally, MVRs are a tool to help ensure that a business puts only qualified, safe drivers into its vehicles. Or, equally important, the organization only permits safe drivers to use their own vehicles on company business. It is a well-established law that while an employee is conducting company business in their own personal vehicle, in the event of a mishap the company’s workers’ compensation and potentially other liabilities can come into play, adversely affecting the business.

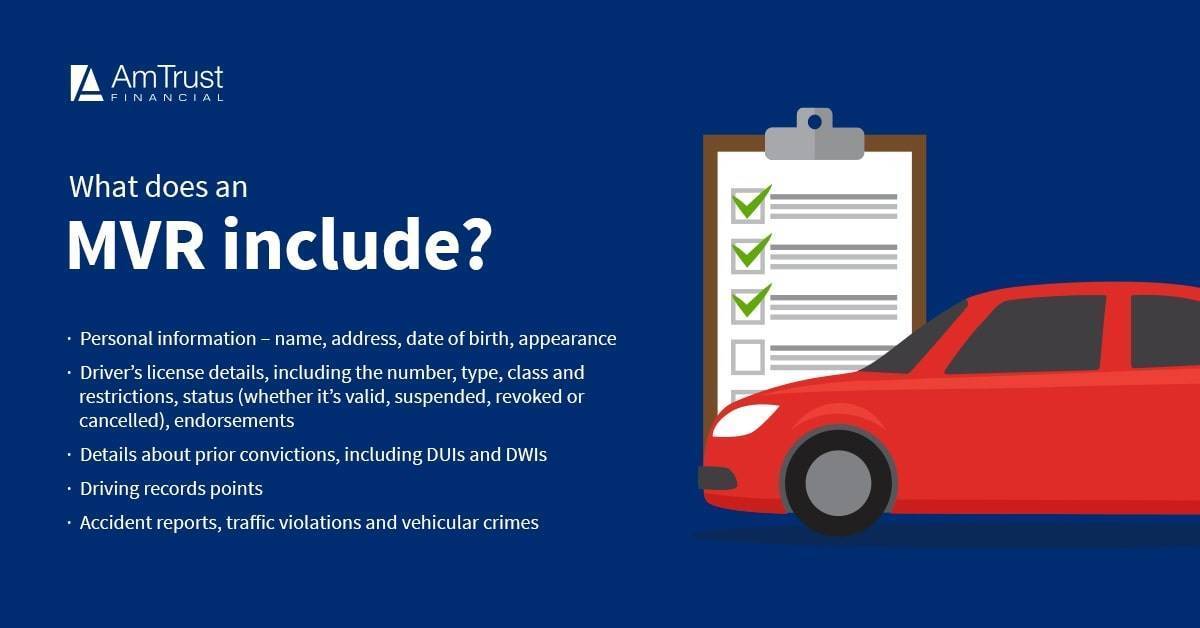

An MVR provides information not always found in a standard employment screening test, like a criminal background check. The type of information you can expect to learn from an MVR includes:

few reasons small business owners should conduct annual MVR screening include:

MVRs are predictive – they are “crystal balls.”

MVRs provide information not only regarding an employee’s future driving habits, but also how he or she will drive while on company business. Some believe that how a driver acts in his/her personal vehicle has no bearing on how they’ll behave in a company vehicle, but a driver engaging in risky behavior in their own vehicle faces traffic violations, potentially becoming involved in preventable accidents, increased insurance costs and other personal consequences. With this motivation, does it seem likely that a driver would be any more careful with someone else’s (your business’s) vehicle? Or that someone would successfully be able to shift between multiple sets of driving habits and attitudes?

MVRs are the tip of the iceberg.

Most drivers will admit they have committed at least a small violation without being caught. Various studies have tried to establish ratios of how many violations are typically committed before being observed by a police officer and cited. For instance, one such study suggests that the average offender has driven drunk at least 80 times before being caught.1 So the violations, citations and accidents that appear on MVRs are just the tip of the iceberg, and to some extent, can reasonably be considered part of a wider pattern of adverse behaviors behind the wheel. Often when confronted, the driver may claim “but it was the first time I ever went through a stop sign!” and while this may be true, our own experiences and studies show it’s not likely the case.

“But we’re such a small company, I know all my people well. I’d know if they had an accident or got a ticket.”

Yes, you would know if an employee crashed or caused physical damage to a company vehicle, but what about violations? You may think you’d know about those, too, but try the family test—can you honestly say you know about the violations, tickets and even minor accidents your adult family members have at any given time? Most adult children cannot answer this question about their own parents, let alone about their siblings. And if you don’t know this information regarding your own family members, who have no real motivation to hide adverse driving information from you, could you expect that potentially adverse information—that could cost someone their job—to come to light through “the grapevine?”

MVRs can help verify drivers’ licenses and applicants’ claims about driving history.

Fake drivers’ licenses are not hard to come by and when a good-paying job is at stake, there could be motivation for an applicant to resort to dishonesty to obtain or retain a job. Discrepancies between what is claimed and what an MVR says, or an MVR that comes back with a “no license found” notation can be a starting point for an employer to clarify the situation and get to the facts.

MVRs should be checked before allowing any employee to drive on company business.

Some business owners may depend on their insurance company or insurance agent to check driver MVRs. The problem with this is twofold: One, some insurance companies only do spot checks on random drivers, and not necessarily every year. Secondly, if you allow a new employee to drive on company business, and then later—in some cases, much later—learn from the agent or the insurance company that this driver has an unacceptable driving record, it becomes a much bigger problem for you at this point. Or worse—it’s possible you won’t find out you’ve put a problem driver on the road until an accident occurs! Often, the need for a replacement driver comes up suddenly, so when possible it is recommended that alternate fill-in drivers be pre-qualified via MVR checks and other tools. This way you can ensure they’ll be ready to go when and if needed, thus eliminating the need for “panic” driver hiring/assignment.

Life circumstances change, so MVRs should be checked at least annually.

Any number of life events such as death of loved ones, divorce, illness and others can result in drinking or drug abuse, or other problems that cause undesirable driving behaviors that are reflected in MVRs. In some cases, a driver may be able to successfully hide these behaviors from the employer. Gaining this information through annual MVR reviews before a bad accident or other incident occurs is a major benefit of a strong MVR review program.

Negligent entrustment.

If you are guilty of negligent entrustment, this means that you entrusted (gave, or allowed someone to use) something potentially dangerous to a user who caused injury to a third party due to incompetence. In other words, if you permit someone to drive on company business without determining that the driver is competent and capable behind the wheel, you can be charged with negligent entrustment. MVRs are recognized as an effective tool for use in determining driver competence and safety, so failure to use MVRs to ensure your company drivers are competent and capable can be considered negligence on your part. If a court finds negligent entrustment this can potentially increase the losses incurred from a traffic mishap. Conversely, in the event a serious accident occurs despite your best efforts, being able to demonstrate that MVRs are a central part of your driver qualification and annual review process can create a strong defense against accusations of negligent entrustment of a motor vehicle.

Loss Control from AmTrust Financial

AmTrust’s

Loss Control Department provides a variety of resources to help you identify the specific hazards small and medium sized businesses face. We are dedicated to providing the right recommendations and resources necessary to create the most effective loss prevention program for your specific needs. Please

contact us today to learn more.

Sources: Mothers Against Drunk Driving (MADD), citing US government FBI and CDC reports,

https://www.fbi.gov/about-us/cjis/ucr/crime-in-the-u.s/2014/crime-in-the-u.s.-2014/tables/table-29, Incidence data;

http://www.cdc.gov/mmwr/preview/mmwrhtml/mm6430a2.htm;

https://www.madd.org/statistics. Retrieved January 7, 2019.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact with your local RSM for more information.