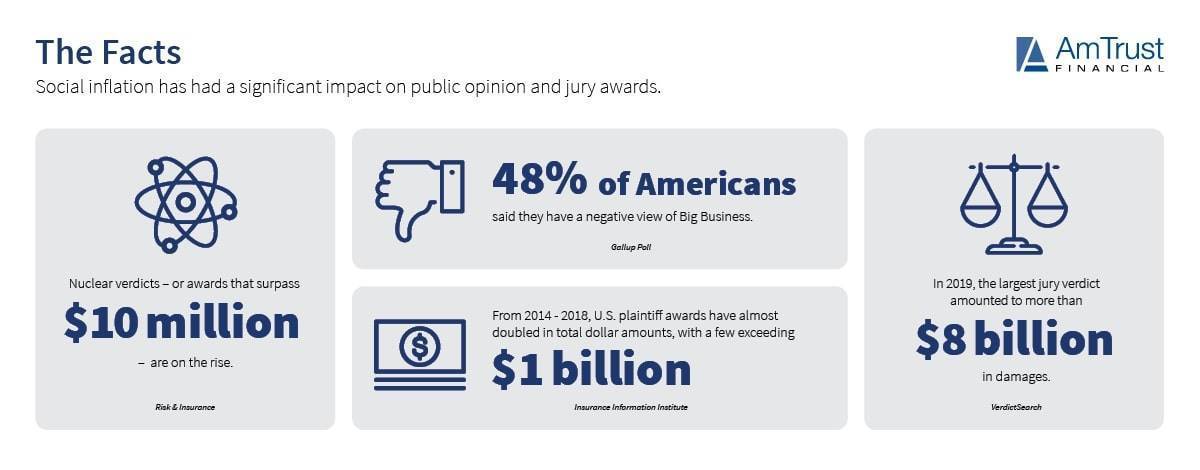

Summary: Social inflation refers to how insurers’ claim costs could rise over general economic inflation. This article will discuss the causes of social inflation, trends in social inflation from the COVID-19 pandemic and what businesses can do to protect themselves. Download Social Inflation Infographic What is Social Inflation?

Social inflation refers to the rising costs of insurance claims due to various factors, such as socioeconomic, legal and behavioral trends that change over time to drive more – and bigger – lawsuits. These factors are generally the most pronounced in the United States, where adversarial legal procedures are combined with a litigious culture, leading to lawsuits and high jury awards or settlements.

A review of cases in the U.S. shows that the number of verdicts resulting in $20 million or more in 2019 has

risen more than 300% from the annual average between 2001 and 2010. And, over the last five to six years, there’s been a steady

increase in verdicts over $1 million.

According to Duffy Koller, Head of AmTrust's Excess and Surplus Lines, “It is our obligation as insurers and producers to educate and assist our insureds on how we can mitigate the rising costs of litigation and settlement awards, fueled by social inflation, with loss control tools and clearly defined coverage terms.”

Causes of Social Inflation

The underlying drivers of social inflation include:

- Erosion of caps on punitive damages for pain and suffering. Several state court decisions strike down non-economic and punitive damage caps – punitive damages are awarded not to compensate the plaintiff but to punish a defendant for intentional or malicious misconduct.

- Media outlets and social media impact on public opinion. No matter how extreme, ideas and opinions can be easily shared on social media and can affect how people feel about certain issues.

- Perception of how the value of money has changed. The media has also made it appear as though large payout verdicts are more common, and juries believe defendants, especially larger corporations, can pay out much larger sums of money to plaintiffs.

- Broader definitions of liability. A liability is defined as an “obligation between one party and another not yet completed or paid for.” The general feeling that someone should pay when there’s been damage or injury, regardless of negligence, is growing consistently.

- Increasing litigation and changes to litigation funding. Bans prohibiting litigation funding – the practice of third parties financing lawsuits in exchange for a share of funds the plaintiff might receive – have diminished and have increased insurance payouts and loss ratios.

- Attorney technology, marketing and analytical advances. Increases in attorney advertising have led to more frequent attorney involvement in some types of insurance claims and increases in claim frequency and expectations of larger settlements. Attorneys use social media and analytics to reach a larger pool of potential plaintiffs, and social media and analytics are also utilized in choosing pro-plaintiff jury members.

- Tort reform rollbacks. State regulations are being modified to reduce the amount of time during which a lawsuit can be filed. These regulations are also setting monetary caps on the punitive and non-economic damages that can be awarded.

- Higher jury awards and changing jury composition. The changing composition of the jury pool has a potential impact on how cases are viewed and awarded.

- Plaintiff-friendly legal decisions. Aggressive plaintiff attorneys are becoming savvier, playing jurors’ emotions to make them more likely to rule in favor of the plaintiff, regardless of the facts surrounding the case.

- Public distrust of corporations. The distrust the public has on larger businesses and corporations can lead to juries sympathizing with the plaintiffs, regardless of the level of fault on the defendant.

Social Inflation Trends from the COVID-19 Pandemic

Initially, liability claims have decreased over the past few months as a result of the COVID-19 pandemic. However, this response is thought to be only temporary as the economy continues to recover and legal proceedings begin to increase once again. Ultimately, the pandemic could

accelerate the underlying drivers and make the claims landscape even more challenging for insurers.

Even before the COVID-19 pandemic hit, social inflation for the commercial liability business was increasing and

continued to increase throughout 2020. In the first half of the year, insurance companies reported more than $20 billion of pandemic-related claims, especially in property business for companies who saw cancellations in events and other interruptions in business.

Other liability segments that could see a rise in claims due to the COVID-19 pandemic include professional, D&O and cyber liability. Industries such as healthcare and tourism may see a rise in litigation when the pandemic comes to an end. It’s probable that liability claims caused by COVID-19 will be substantial, spread out over several years instead of several quarters, as legal procedures are bound to be lengthy and delay settlements.

The Impact of Social Inflation on the Insurance Industry

Many areas of insurance have felt the effects of social inflation. Those that have seen the greatest impact include:

- Commercial Auto

- Medical Malpractice

- Directors & Officers (D&O)

- Umbrella

- Excess Liability

- General Liability

Historically, social inflation has affected the commercial auto sector the most. There’s been an increase in loss ratio values in commercial auto since 2015, with awards and settlements for accidents routinely

topping $10 million.

What Can Small Businesses do about Social Inflation?

Businesses can take certain steps to help protect themselves against social inflation, including:

- Stay educated. Companies need to be certain they understand their risks and the current business environment.

- Be proactive. Continually update the employee handbook to include harassment and other employment practices. Communicate and enforce the policy, so all employees are on the same page.

- Invest in safety. Along with understanding what risks a business faces, they should also live and breathe a culture of safety to reduce accident potential. Work with a risk management team or loss control department that can identify hazards and provide solutions to help reduce workplace accidents.

- Partner with experts. Enlist the help of a knowledgeable, reliable insurance agent and carrier who can provide adequate coverage to protect the business.

AmTrust E&S Insurance

AmTrust Excess & Surplus insurance offers clients a wide range of standard and specialty insurance products for unusual or hard-to-place risks. Our small, focused and experienced underwriting team is comprised of industry leaders, adept at understanding, handling and supporting complex accounts. For more information about our

E&S insurance products, please

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.