Summary: May is Mental Health Awareness Month, and employee mental health has been top of mind for employers for several years, but especially since the coronavirus pandemic in 2020. Find out why focusing on whole-person wellness is key to a successful workers’ compensation program, and learn what employers can do to support their employees’ mental health throughout the year. What is Mental Health Awareness Month?

Mental Health Awareness Month, or Mental Health Month, was established by

Mental Health America (MHA) in 1949 to increase awareness of the importance of mental health and wellness, and to celebrate recovery from mental illness. Mental Health Awareness Month is celebrated every May with the support of organizations like the

Substance Abuse and Mental Health Services Administration (SAMHSA) and the

National Alliance on Mental Illness (NAMI). The 2023 theme is “More Than Enough,” promoting the idea that everyone, no matter their background, physical ability, appearance, socioeconomic status, etc., is worthy of more than enough life, love and healing. Showing up for yourself and those around you is more than enough.

Tremendous strides have been made over the last 20 years to improve the outlook of those affected by mental illnesses and promote acceptance and support of those with mental health conditions. MHA continues to educate the masses about mental illness and provide access to treatments that can lead to a fulfilling life.

Mental Health and the Workplace

Millions of Americans suffer from mental health conditions. In fact, NAMI reports that

one in five adults experience a diagnosable mental health condition in any given year, and 10 million adults in America live with a serious mental illness.

Reports of anxiety, depression and substance abuse in the workplace have been on the rise over the last several years. The COVID-19 pandemic played a large role in exposing the impact work can have on individuals' overall well-being, and a survey from the U.S. Surgeon General reveals that

76% of workers report at least one symptom of a mental health condition. Eighty-four percent say their workplace had contributed to at least one mental health challenge.

Employees in certain industries are at a higher risk for mental health issues due to the workplace, such as healthcare workers and those in the

hospitality industry. These industries can be challenging due to the fast pace and stressful situations workers often experience.

Why is Improving Mental Health in the Workplace Important?

Work impacts our mental health and vice versa; our mental health can impact our work. When our mental health suffers, how well we can do our jobs and our productivity levels often suffer, too. Some estimates suggest mental health issues

cost the global economy $1 trillion annually due to lost productivity, absenteeism and staff turnover.

The average full-time employee spends almost half their waking life in the workplace. Thinking of it in this light, it's easy to see why offering a supportive work enviroment should be top of mind for all employers. In the American Psychological Association's (APA)

2022 Work and Well-being Survey, it was discovered that 71% of workers believe their employer is more concerned about their mental health now than in the past. However, there are still some issues that need to be improved, such as some groups feeling discriminated against and a failure for compensation to keep up with rising inflation. Eighty-one percent of employees said if they look for future work, employers' support for their mental health will be an important consideration in taking the job.

Mental Health and Workers’ Compensation: Focusing on Whole-Person Wellness

It’s also important to consider other factors that can take a toll on an employee's mental health. For example, following a workplace accident, it’s common for injured workers to experience depression. One

group of researchers found that employees injured at work were more likely to become depressed than those injured outside of work. Worries about finances, losing their normal routine and returning to work successfully were cited as top reasons for injured workers’ depression.

For a long time, employers were focused solely on treating the visible injuries an employee suffered in a workplace accident. However, studies have shown that even

minor injuries can have a negative impact on mental health, creating feelings of anxiety and depression even in a mentally stable person. These feelings do not necessarily go away once the employee is healed physically, either, as the individual may not be mentally ready to return to work. Feeling unprepared can lead to even more stress, and worse, possible re-injury.

Before the start of the pandemic, many employers were beginning to implement communication strategies with injured workers to help focus on all aspects of their health and recovery. In

an article in Risk & Insurance, AmTrust’s Melissa Burke, pharmacist and head of managed clinical care, suggested, “If we identify that an injured employee has the potential to decompensate or is stressed, we’re engaging our nurses early on.” This means ensuring the injured worker has access to additional resources available through the employer, such as their employee assistance program (EAP) or

telehealth behavioral services.

Workers’ compensation programs have shifted to consider the injured worker’s physical health, mental health and social environments when creating individualized treatment plans. This focus on whole-person wellness helps ensure a successful return to the workplace.

Mental Health Support for Employees

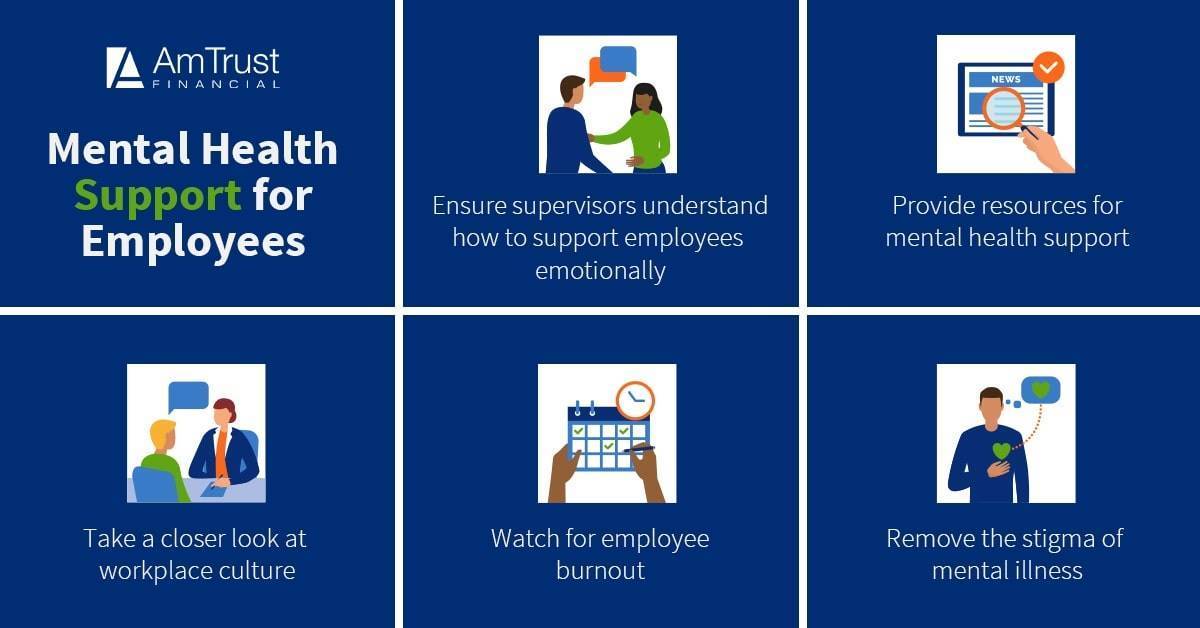

MHA discussed some of the things employers can do to help improve employee mental health at the workplace, which include:

- Ensure supervisors understand how to support employees emotionally. When employees feel they can discuss stressful situations with their supervisors, the workplace becomes a healthier environment.

- Provide resources for mental health support. A safe workplace is strongly associated with the amount of resources offered for emotional support, such as accessing insurance benefits or an EAP.

- Take a closer look at workplace culture. Is leadership considering employee feedback on issues? Identify areas that could use improvement within the company culture, which should reflect the organization’s mission and values.

- Watch for employee burnout. MHA’s Mind in the Workplace 2021 Report revealed that 99% of workers who feel emotionally drained by their work agree that workplace stress affects their mental health. Employers should understand the signs of burnout and offer flexibility as needed.

- Remove the stigma of mental illness. No one should feel alone when struggling with mental health conditions. Employers should assess their mental health practices and work to create a welcoming environment for all employees, including for those living with certain mental health condition.

Comprehensive Workers’ Compensation Coverage from AmTrust Financial

AmTrust Financial is one of the nation’s largest writers of all

types of commercial insurance for small businesses. As a trusted partner since 1998, we understand and support small businesses as they begin to adapt to a post-pandemic workplace. Find out more about our

small business insurance solutions by

contacting us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.