Summary: The number of workplace injuries has decreased in the last 15 years, but the average cost of accidents in workplace are rising. Learn how having a workplace safety program impacts workers’ compensation costs. Understanding the True Cost of Occupational Injuries

Workplace injuries have declined, but accidents can still happen. These on-the-job accidents can cost individual businesses thousands of dollars per year in medical and other expenses. The

National Safety Council found that the total cost of work injuries totaled $161.5 billion in one year. That equates to $1,100 per worker, which includes the value of goods or services each worker must produce to offset the cost of work injuries. The average cost per worker death was $1.15 million, while the average cost per medically consulted injury was $39,000.

Approximately 2.8 million nonfatal workplace injuries and illnesses reported by private industry employers annually, according to

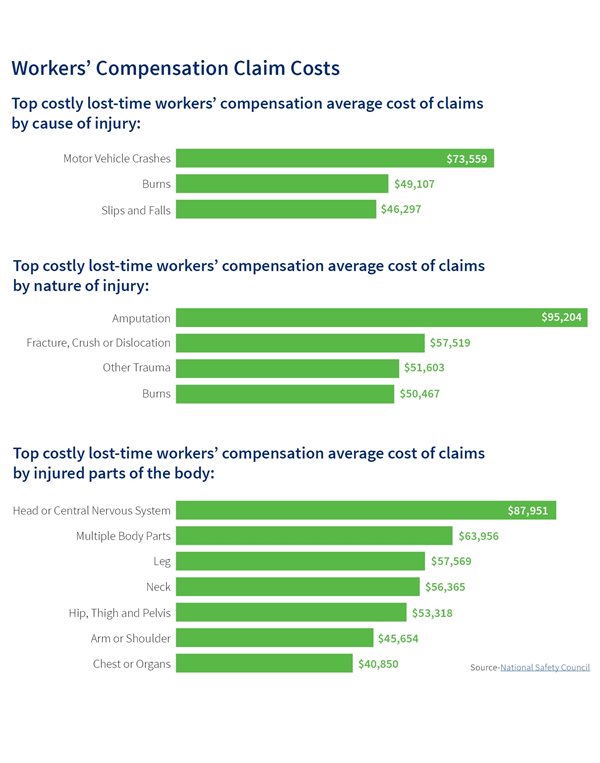

Bureau of Labor Statistics. The National Safety Council broke down the

costs below to show the average payout for an accident at work by cause of injury, nature of injury and injured body part.

Average Cost of Accidents in the Workplace

What is Workers’ Compensation Insurance?

The graphic above shows that the average cost of workers’ compensation claims can be quite expensive – and that’s just for the medical expenses. According to the

Occupational Safety and Health Administration (OSHA), “Workplace injuries and illnesses have a major impact on an employer's bottom line. It’s estimated that employers pay almost $1 billion per week for direct workers' compensation costs alone.”

Workers’ compensation insurance protects a business and its employees if there is an injury on the job. These benefits can address medical care and related medical costs, retraining, lost wages until the employee can return to work or compensation for permanent disability.

What is the Average Cost of Workers' Compensation Insurance?

A logical question when looking into small business insurance is wondering how much workers' compensation insurance will cost? The answer to this question varies greatly depending on the size of your company, the industry you’re in, your location, the number of employees you have and your revenue.

CoverWallet says "typically, a small business owner with a few employees can expect to pay around $2,000 to $3,000 in Workers Compensation Insurance premiums annually. As an employers payroll increases, premiums will also increase."

Get a quote now.

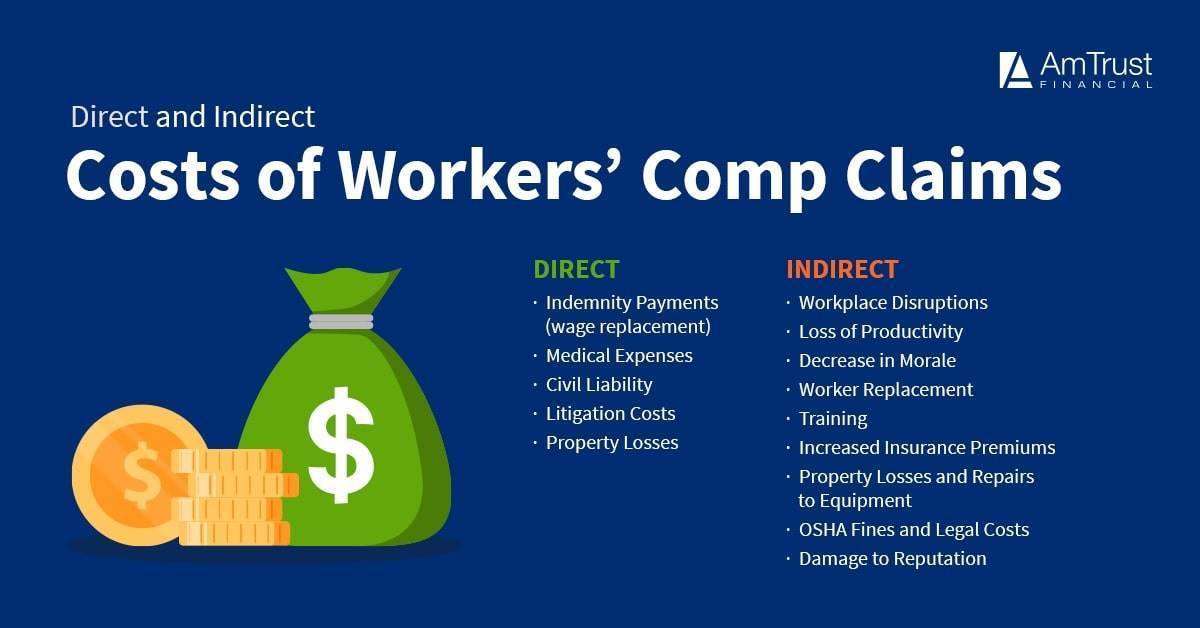

Direct vs. Indirect Workers’ Compensation Costs

The true cost is much more than just the cost of workers’ compensation insurance and medical bills. Employee injuries can impact the workplace both directly and indirectly. Direct costs are the upfront costs. The indirect costs are all of the long-term costs that affect a business’s bottom line, sometimes totaling up to 20 times more than direct costs.

Work-Related Injuries Impact Productivity

If you are new to your job, the chances of suffering a work-related injury are much higher. The

Bureau of Labor Statistics found that nearly 40 percent of workers injured had been on the job less than a year. New workers are more likely to get hurt because they lack the experience, training and information needed to properly protect themselves while performing their duties.

A company’s productivity and profitability lessens when even just one worker is absent or has to be replaced due to a workplace injury. Days lost is one of the largest contributing factors to higher indirect costs to a business after an injury.

What is a Workplace Safety Program?

Knowing the overall cost of workplace injuries could help convince managers and executives to invest more in safety or loss control programs. The

financial return on investment (ROI) of these types of safety programs are revealed in increased productivity, improved customer service, savings from fewer injuries and lower workers’ compensation costs – though these savings may take time to realize.

Building a

successful safety program takes planning and time for the program to become effective. The program should be evaluated periodically to ensure its effectiveness, and it can and should be modified as needed. Management should keep their employees interested and involved in the safety efforts by continually promoting the program.

Cost Control for Workplace Employee Injuries

Part of a safety program is controlling the costs of workplace injuries. A small percentage of employee injuries account for a very high percentage of the total injury costs for a business.

Serious employee injuries must be well managed in order to keep the total accident costs to a minimum. A closely coordinated effort between company management and their insurance carrier will ensure injury costs are well controlled. Employers can educate management teams in

cost control techniques to help minimize the costs of injuries to their employees.

AmTrust’s Risk Management Solutions

Download a free copy of our

ROI of Safety white paper to find out more information about controlling the cost of workplace injuries by implementing a dedicated workplace safety program.

AmTrust knows that safety training is key to a proactive approach to minimalizing injuries, incidents and controlling overall costs.

AmTrust’s Loss Control Department can help insureds by providing the right

safety resources and commercial property safeguards to ensure their ongoing success.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.