Summary: Due to historically high used vehicle values, today’s GAP insurance claims are very favorable, but that could change once supply chain issues are resolved. Learn how this market fluctuation impacts today’s costs and why it is crucial to adapt business practices to prepare for future shifts.

A new vehicle starts to depreciate as soon as it is driven off the car dealer’s lot. According to the

Insurance Information Institute, a car's value can go down 20% to 30% in the first year and continues to decline over the time of ownership.

What is GAP Insurance?

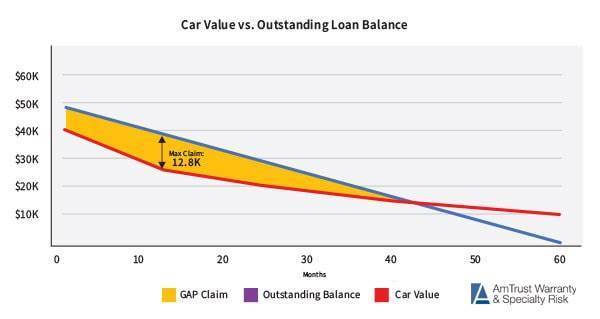

GAP insurance, or “guaranteed asset (or auto) protection,” ensures that vehicle owners won’t incur a loss if the vehicle is damaged beyond repair (total loss), such as in an accident or flood, or if the vehicle is stolen and never recovered. GAP coverage pays the difference between what the insurer pays (settlement amount) and the amount still owed on the borrower’s loan. The settlement amount is based on the car's actual cash value at the time of the incident: the cost of the vehicle when it was new, minus depreciation for age, mileage, physical condition and other factors. As an example:

- Car age at the sale (in months): New

- Car Depreciation Level: High

- Loan Term: 60 months

- APR: 2%

- Car Value: $40,000

- Loan Amount: $48,000

- Loan to Value (LTV): 120%

The shaded area represents the difference in the Outstanding Loan Balance and the Car Value, or what GAP coverage would pay if there were a total loss.

A Look at the Current GAP Insurance Marketplace

Frank Amendola, SVP, Underwriting at

AmTrust Specialty Risk, said supply chain issues are influencing today’s GAP Insurance Marketplace. “The global microchip shortage has brought new vehicle production to a halt during the pandemic. The lack of new car availability has created an overall vehicle supply shortage. Additionally, we have seen higher vehicle demand, driven primarily by higher household savings due to federal stimulus during the pandemic, low interest rates and tax credits. The decreased supply and increased demand have driven up the price of used cars.

The

Manheim Index tracks used vehicle values and illustrates the skyrocketing values that Amendola describes:

The higher used car values are, the higher the insurer’s settlement amount and the lower the GAP payment is, reducing the average severity of a GAP claim. Additionally, if the settlement amount is greater than the outstanding loan balance, a GAP claim will not be filed, driving claim frequencies down. Because of these factors, we are currently observing lower overall claims and favorable loss ratios on GAP.

Amendola explains how the market can easily change. “As long as new car production lags behind, supply will not meet consumer demand and used car values will remain high leading to strong GAP loss ratios. However, we know this is not sustainable. It is a

fair assumption that in 2022 or 2023, chip production, and correspondingly, car production, will move closer to pre-pandemic levels. As that occurs, used car values will come down which will drive insurers’ settlement amounts to be lower and GAP payments will rise sharply. As customers finance their vehicles, the over-inflated vehicle values correspond to the amount financed. For example, a used car that was worth $10,000 prior to the pandemic is now worth $14,000, and customers have to get a loan for $14,000 to finance the vehicle. If car values revert to pre-pandemic levels, that $14,000 vehicle could drop in value immediately, causing a much larger difference between a consumer’s outstanding loan balance and vehicle value. This could lead to tremendous losses for a GAP program.

“GAP risk is a long-term commitment, tied to loan terms (on average 6-7 years),” Amendola further explained. “So, there needs to be thoughtful consideration to ensure that you are pricing your GAP program now for the impact of a future return to normalcy.”

Shifts in the GAP Insurance Market to Watch

The GAP insurance marketplace continues to adjust and react to supply chain and availability issues. Some indicators of possible shifts in the market to keep an eye on include:

- Vehicle values: Several factors could impact vehicle values:

- Vehicle Demand

- Change in travel or general vehicle usage

- Economic recession causing reduced vehicle purchases

- Gas price fluctuations

- Vehicle Supply: Resolution of supply chain issues increasing market inventory

- Increased APRs that could be driven by inflation

- Longer loan terms

- A surge in driving accidents

AmTrust Advantage

The future of GAP insurance will look different. The GAP coverage being sold today is reflective of the inflated values driven by the market factors. If values come down, it will widen the gap, creating higher claims and potential losses to a program. Amendola shares an advantage of partnering with AmTrust for GAP, “AmTrust sensitivity modeling will allow you to be wise to the impacts to your books. AmTrust is positioned to help you navigate every turn of the GAP cycle, even the downturns.”

Partner with AmTrust Specialty Risk as GAP Insurance Provider

From underwriting to reinsurance,

AmTrust Specialty Risk can help your business meet the coverage needs of your partners and their customers. We can offer flexibility, industry-leading support, industry insight, innovation, strength and staying power, and unmatched protection.

Contact us to learn more about our

automobile extended warranties and other specialty warranties.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.