With new automobile technologies, many of which were showcased at

CES 2019, cars are becoming extensions of a smart home. Buying a car is a big investment no matter the age of the customer, and consumers are looking for additional ways to protect their new purchases. In an effort to learn more about changing customer needs,

AmTrust Specialty Risk commissioned a survey of 853 U.S. adults who currently own or lease a vehicle to learn more about their attitudes towards buying and using a vehicle service contract in our Vehicle Protection Plan Survey.

Vehicle Protection Plan Survey Findings

A vehicle protection plan, also known as an extended warranty, provides consumers with additional protection on their newly purchased vehicle. It provides users with the confidence that their vehicle is protected from untimely and costly repairs associated with mechanical, electrical and electronic breakdown that may not be covered by the vehicles’ original manufacturer’s warranty.

The survey found that 39 percent of vehicle owners bought a vehicle protection plan, with 29 percent of the responders saying that they “always buy” vehicle protection plans. Why do consumers buy vehicle service plans? Based on the survey results, the top reason consumers choose to buy protection plans are:

- 63% said the coverage gave them peace of mind

- 49% said the coverage of plan

- 41% said the length of coverage

- 37% mentioned the additional benefits

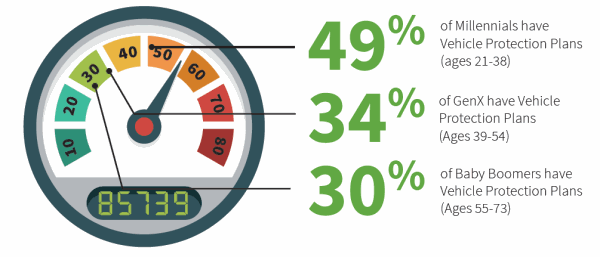

The age group purchasing vehicle protection plans is similar to the findings of the

smart device survey, as the generation purchasing more plans are Millennials.

Consumers are Interested in Online Enhancements to Vehicle Service Plans

We asked survey respondents how interested (from somewhat to very interested) they would be in purchasing a vehicle protection plan if there were additional services available either online or via a mobile application. The top-rated enhancements were:

- Discounts for regular vehicle maintenance

- Get lost keys returned for free

- Auto insurance discounts for good driving behavior

- Store your entire service history

- File claims, schedule service, track service progress and get notification when your vehicle is ready for pickup

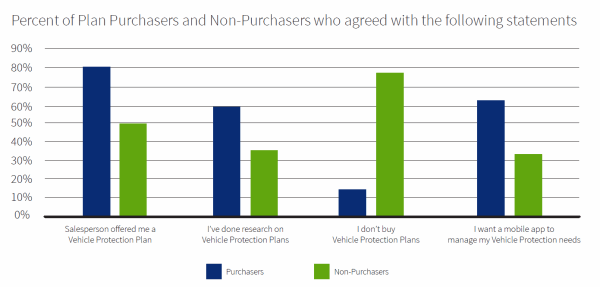

Different Attitudes About Vehicle Protection Plans

The survey also delved deeper into the opinions of vehicle plan purchasers versus non-purchasers. It found that there are major differences in the sales process for consumers who purchased a plan and those that didn’t. For example, 82% of the purchasers said a salesperson offered them a vehicle protection plan, compared to only 50% of non-purchasers.

Vehicle Protection Plans from AmTrust Specialty Risk

AmTrust Specialty Risk is a leading global provider of insurance for manufacturers, distributors, retailers, financial institutions and third-party administrators. Our industry-leading partnerships and underwriting expertise, combined with niche marketing knowledge, allow us to develop customized specialty insurance programs. We have experience in extended warranty products, extended service plans and accidental damage plans.

To learn more about the findings in the Vehicle Protection Plan Survey and AmTrust’s lineup of

motor vehicle protection and ancillary products,

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.