Strains and sprains from lifting heavy objects, repetitive motions, falling from heights, being struck by a product falling off a shelf, slips and falls, cuts from opening boxes with sharps, even

auto accidents – these are all injury risks faced by the retail workforce.

Our research shows that in a scenario in which two retail workers suffer the same injury, their claims can act very differently based on who is filing the claim. AmTrust Financial’s review of Store 4-Wall class codes revealed some interesting data around demographics and workplace injuries in the retail industry. There is a clear difference between the frequency and severity of workers’ compensation claims when factoring in age and gender.

Workers’ Compensation Claim Analysis: Age

AmTrust’s Retail Risk Report yielded the following statistics when analyzing the age of workers’ compensation claimants:

- Ages 18 to 30 had the highest reported number of claims (6,936), though this group tends to make up a larger portion of the workforce than other ages.

- The 51 to 60 age group led the way in the highest average lost time with 31 days, followed by the 41 to 50 group with 30 days. The over-70 age group averaged only 26 days lost.

- Workers aged 18 to 30 had the highest reported claim count, but the over-70 group was nearly four times more costly per claim.

- While the 18 to 30 age group accounted for the highest reported percentage of injuries (31.7% of total), they had a lower payout overall than most age groups (accounting for only 15.7% of payouts) and a shorter lost time than older age groups.

- The over-70 age group accounted for less than one percent of claims but had the highest average payout per claim at $14,408. The data shows a correlation between higher age and higher payout, with the lowest average payout for the under-18 age group ($1,995 on average).

- The 51 to 60 group registered the highest total losses at $43.9 million, followed closely by the 41 to 50 group at $43.7 million.

Matthew Zender, AmTrust’s Senior Vice President of Workers’ Compensation Strategy, discussed the topic of age and workers’ compensation claims in a

recent article from Risk & Insurance.

“Aging workers have different needs when they’re injured. Their claims tend to act differently. Their recovery periods tend to be more prolonged,” Zender said. “There’s special care that needs to be applied to make sure that they’re getting the appropriate medical attention.”

“With an older worker, the body just doesn’t have the ability to bounce back the same way that it would have,” Zender said.

Whether it’s for financial reasons, a desire to keep active and stay connected to others, or the need to keep feeling a sense accomplishment from completing a task or project, people are working well into their golden years. There is good news for workers’ compensation programs, however. Individuals working into and beyond retirement age can actually make companies safer. Our data shows that while their injuries can be more severe and involve a higher payout, their claim frequency is far less than their younger co-workers, most likely due to their experiences with working safely.

The data shows that younger workers take greater risks, are less trained and experienced, and therefore have higher frequency of accidents. Older workers know how to work smarter, have better attendance, are more experienced and more risk-averse.

Learn more about the impact of the aging workforce on workers’ compensation claims

here.

Workers’ Compensation Claim Analysis: Gender

Are men more likely to be injured at work than women? AmTrust’s claims data shows that men reported more injuries, and their injuries resulted in more loss time and higher average payouts. Researchers point to different hazards presented in traditional gender dominate roles and industries. This is consistent with other studies that show men are more likely to be injured at work, including data from the U.S. Bureau of Labor Statistics (BLS).

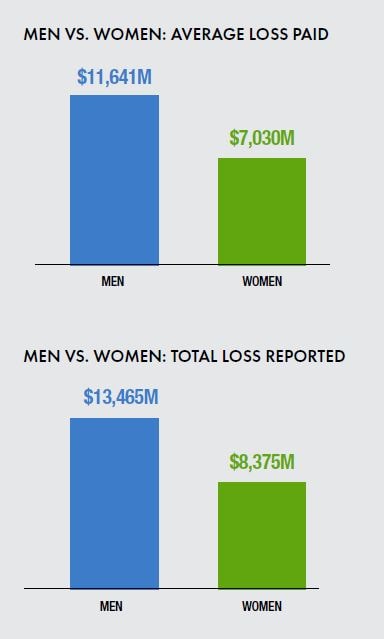

The total amount of losses paid, as well as the average loss paid, is greater for men than for women as well:

For more in-depth analysis of workers’ compensation claims in the retail industry, read the full

AmTrust Retail Risk Report here.

AmTrust is Your Workers’ Compensation Coverage and Risk Management Solution

AmTrust is a leader in

workers’ compensation insurance for small to mid-sized businesses. We can design specific insurance packages to fit your retail clients’ needs. Our coverage combined with our comprehensive

workplace safety training resources can help protect your retail clients from risk. For more information, please

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.