By Ted Pannkoke, Complex/Specialty Claim Adjuster

Employers should engage in good employment practices because both the law and sound HR policies require it. However, for everything an employer can do to minimize its EPL risk, there’s one factor out of every business’s control: the state of the economy.

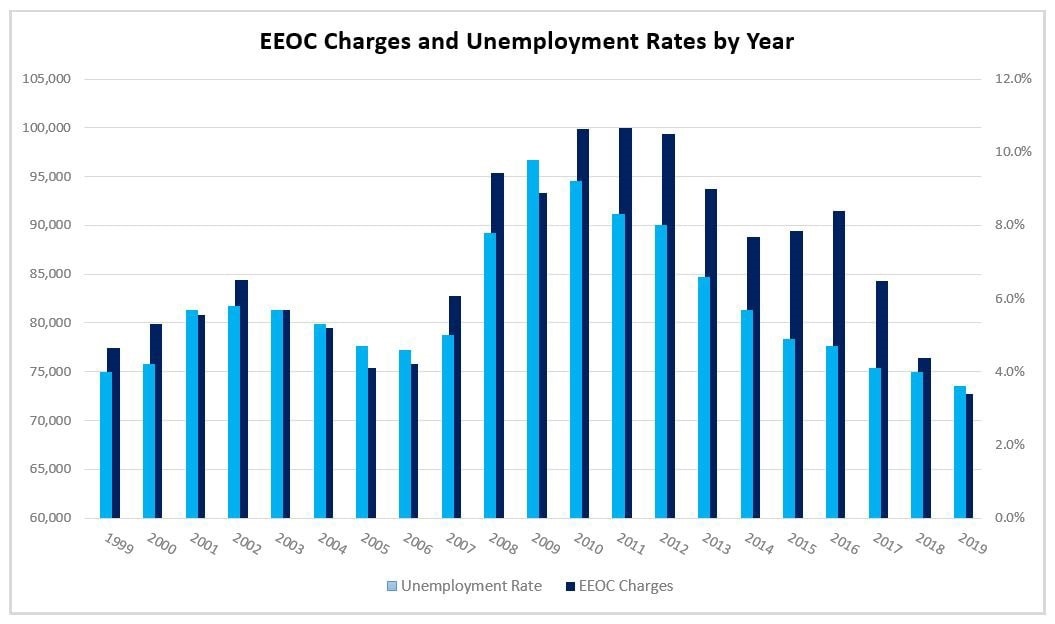

Common sense might deduce employees would be less likely to make formal EPL complaints in healthy economic environments and be more likely to in challenging times. But when plotting EEOC charge statistics right next to the unemployment rate, one sees clear confirmation that this is not necessarily the case.

Attribution to Lawffice Space blog by Philip Miles. Thanks to Kristen Kreuzer and Susan Leech for preparing the chart.

Attribution to Lawffice Space blog by Philip Miles. Thanks to Kristen Kreuzer and Susan Leech for preparing the chart. Clearly, there’s a very strong correlation between “healthy” rates of unemployment (generally considered to be < 5%) and far fewer charges filed in the EEOC, versus high rates of unemployment and a heavy load of EEOC filings. Strong economies see less EPL risk, while struggling economies see more.

This was certainly good news until very recently, when 2019 saw both the strongest employment rate and the fewest EEOC charges in the last 20 years. That’s not to say employers are free to neglect employee relations – or their EPL coverage – as long as the economy stays healthy.

Indeed, as this topic goes to press early in the

global COVID-19 outbreak, employers are faced with unprecedented workplace challenges, and forecasters are naturally speculating about a future recession. Some EPL concerns immediately come to mind.

Currently, the

EEOC discusses coronavirus in connection with the Americans with Disabilities Act and the Rehabilitation Act. For example, there is existing EEOC guidance titled “

Pandemic Preparedness in the Workplace and the Americans with Disabilities Act.” As this topic goes to press, the EEOC says that the ADA and Rehab Act rules still apply. Yet, they don’t interfere with or prevent employers from following the

CDC’s guidelines and suggestions about steps employers should take regarding the coronavirus.

If the COVID-19 pandemic should result in a recession or a real increase in the unemployment rate, it’s not hard to predict a rise in employment claims, and that they’ll move from health- and disability-based complaints into others. It’s not hard to imagine EEOC charges that work-from-home, furlough, and layoff decisions were made using prohibited standards of race or gender, or based on perceived retaliation. It’s not hard to anticipate allegations that those decisions had disparate negative impacts on one protected class or another. In a situation that’s going to be highly stressful for management and employees alike, poorly-handled face-to-face interactions and poorly-worded directions and coaching could be construed as creating hostile work environments. In any event, it seems safe to expect that employment decisions relating to COVID-19 will, unfortunately, carry some degree of EPL risk.

Knowing that the economy runs in cycles, if the data shows anything, it’s that

EPLI protection will not be a luxury, rather a necessity, in a challenging economic climate.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.