Millennials, or anyone born between 1981 and 1996, make up nearly a quarter of the U.S. population. This group is likely the most

studied generation and they have an immense impact on how we shop, eat, do business and get everyday services. Millennials are the first generation that grew up surrounded by technology from computers to smartphones to tablets. With this knowledge, this generation is transforming the small business world.

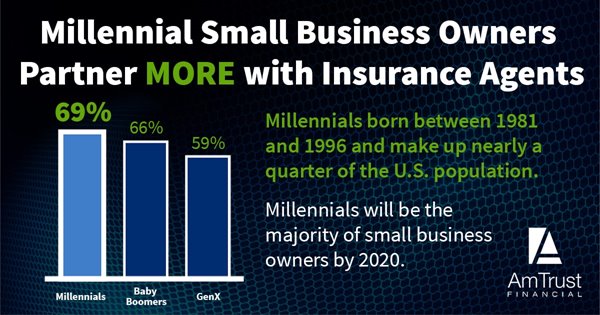

Millennial Small Business Owners Partner More with Insurance Agents

Based on

recent estimates, millennials will be the majority (60 percent) of small business owners by 2020. The Chase for Business, Business Leaders Outlook 2018 report found that millennial small business owners are optimistic, have higher growth expectations and use technology to grow their businesses more than other generations. At 78 percent, millennial business leaders are more excited to learn and use new technology to manage their businesses. This generation is also more aware of the risks that technology can pose and understand the need for cybersecurity to protect their businesses.

Millennials Like Working with Insurance Agents

Even though this generation is the first to grow up and rely on technology, they also grew up during the time of the great recession and

tend to be more cautious with their financial and insurance needs. For this reason, they reach out for in-person assistance from insurance agents more than any other generation of small business owners.

A

recently released survey of business owners sheds some light on how millennial small business owners are looking for stability and long-term success by seeking professional advice. The survey found that 69 percent of millennial business owners work with an insurance agent, followed by baby boomers at 66 percent and Gen X at 59 percent. Small business owners across all generations said they trust the guidance and expertise from their insurance agents. The survey also found that price is the number one factor when selecting an insurance agent, with products and coverage and customer service completing the top three considerations. Also, overall 53 percent of all generational owners have never filed a business insurance claim. However, 70 percent of millennial business leaders have filed a claim for their businesses.

Marketing Directly to Millennials

Thanks to data mining, social media and mobile apps, insurance companies are starting to target their marketing directly to millennial small business owners. Through mobile apps,

insurance agents can give their clients the ability to file and track claims, schedule inspections and even send direct messages agents for questions. The ability to tailor coverages, policies and online tools to this generation of business owners can be invaluable to insurance companies.

With the additional focus on cybersecurity and the risks of using new technologies, millennial small business owners are looking for their insurance agents to assist in offering more robust coverages. For instance,

cyber liability insurance provides a variety of services to address the modern day risks and threats of business identity theft and data breach. For more information about AmTrust’s suite of

small business coverage including cyber liability insurance, please

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.