Summary: Home warranties offer homeowners peace of mind by covering the costs for major repairs or replacing certain systems and appliances. In this article, we take a closer look at some of the main benefits of a home warranty, including how they differ from homeowners insurance. The Benefits of a Home Warranty

A home warranty is a policy a homeowner pays for that covers the cost of repairing home appliances and utility systems if they break down. Home warranties offer homeowners the financial protection and safety of knowing that unexpected problems with their appliances and critical systems, such as HVAC, electrical and plumbing, can be dealt with without large out-of-pocket expenses.

Home warranties offer some definite benefits to homeowners, including peace of mind and a sense of security. A few additional benefits include:

- Saving money on expensive repairs. Homeowners will typically pay less overall for repairs and replacements, especially when expensive appliances and utility systems are involved. Home warranties offer protection from unexpected, surprise repair costs.

- Access to skilled service contractors. Home warranty companies utilize a network of service contractors that can be dispatched for repairs in the event of a claim. This is helpful for homeowners who might not be handy or those who do not have a regular contractor.

- Coverage for breakdowns from normal wear and tear. On average, consumers place two and a half claims per year, and over half of homeowners had a home repair emergency in the past 12 months.

It’s important to note that policy exclusions can lead to claim denials. If coverage is denied, the homeowner must pay the service call fee and pay for any necessary repairs. Home warranties also do not cover “improperly maintained” items – and the warranty company has the discretion to define what that means – and items with pre-existing conditions also are not typically covered. Extensive damage could mean out-of-pocket expenses for the homeowner, or the warranty may only cover repairing items rather than fully replacing them.

How Does A Home Warranty Work?

Homeowners pay a monthly or yearly premium to maintain their home warranty coverage. When a covered item in the home needs to be serviced, repaired, or replaced, the homeowner submits a claim to the administrator of the program. The administrator takes the call and determines the next steps. A licensed and insured service provider is then dispatched to the home to investigate and, when needed, provides repair or replacement to resolve the claim. In this process, the homeowner is protected from paying for the unforeseen costs related to the breakdown. Some programs may require the homeowner to pay a small deductible depending on the coverage.

What Does a Home Warranty Cover?

A home warranty generally offers coverage for major systems and appliances throughout the house. However, it does not cover structural features and doors or windows.

The coverage varies by company and plan, but a typical home warranty can cover any of the following:

- Heating, ventilation and air conditioning system (HVAC)

- Gas line

- Electrical system (interior or exterior)

- Plumbing and drainage system

- Water service line

- Sewer/septic system

- Water heater

- Appliances, such as fridge/freezer, stove/oven/range, built-in dishwasher, built-in microwave, garbage disposal, built-in trash compactor

- Washer and dryer

- Garage door opener

- Coverage for pools, spas, well pumps

- Smart thermostats

- Surge coverage

What Does a Home Warranty Cost?

The cost of a home warranty will vary by company and coverage plan. On average, a home warranty costs around $25-$150 per month. However, there could be additional charges in the form of optional add-ons, deductibles (anywhere from $50-$200), and service fees (typically $60-$100 each time a technician comes to your home).

In the event of a major repair or replacement item is needed, such as an HVAC system that can cost anywhere from $5,000 to over $12,000 to replace, sometimes a home warranty can practically pay for itself. When considering purchasing a home warranty, homeowners should create a list of the home’s major appliances and systems, their ages, and which are most at risk of breaking down or needing replacement. Then, the homeowner can decide which home warranty would best meet their needs.

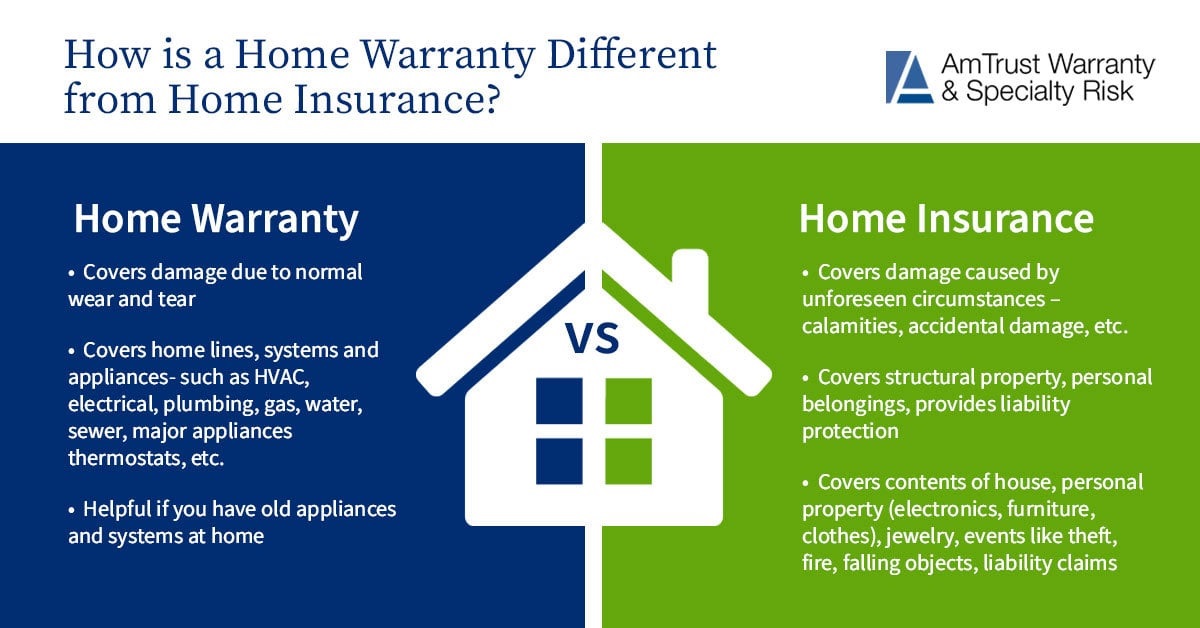

How is a Home Warranty Different from Home Insurance?

What are the Benefits to Having Both a Home Warranty and Homeowners Insurance?

Together, home warranties and homeowners insurance can both provide comprehensive protection for your home and property. These services will help you save on expensive repairs and replacements, protect your valuable assets, and most importantly, give you peace of mind.

Home Warranty Coverage from AmTrust Warranty & Specialty Risk

AmTrust Warranty and Specialty Risk’s

home and utility programs protect against the financial challenge of failing systems and expensive repairs with enhanced coverage bundles. Our home warranties offer a variety of coverage plans to meet your needs. To learn more about our

warranty programs, please

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.