Summary: Risk transfer is a risk management technique involving transferring the risk of injury or property damage caused by a company you hired - a contractor, vendor or other suppliers -- through a contract or insurance policy. Transferring risk examples include commercial property tenants assuming the risk for keeping sidewalks clear, an apartment complex transferring the risk of theft to a security company and subcontractors assuming the risk for the work they perform for a contractor on a property.

Download PDF Version The Benefits of Transferring Risk

Injuries and property damage caused by a company your business hired, such as suppliers, vendors, service providers or subcontractors, can increase your involvement in claim situations that you did not foresee. However, utilizing these companies is often essential to running a successful business. When a business owner begins negotiating contracts for rendered services, there are definite benefits to transferring potential liabilities to the business providing the services.

How to Transfer Risk

Just like other loss control efforts,

transferring risk can help reduce the claim costs your company may face. The most common way to transfer risk is through an insurance policy, where the insurance carrier assumes the defined risks for the policyholder in exchange for a fee, or insurance premium, and will cover the costs for worker injuries and property damage.

With

contractual risk transfer (CRT) your business shares the burden of risk with other businesses. CRT is a common method of shifting risk from one party to the other. It involves a non-insurance contract or agreement between two parties whereby one agrees to hold another party harmless for specified actions, inactions, injuries or damages and indemnify the owner.

In most cases, CRT is effective as long as the contract is aligned with the exposures, complies with any applicable state laws, and was signed by both parties before any damages or injuries occurred.

Real Life Risk Transfer Examples

Let’s take a closer look at some examples of risk transfer comes in real-life scenarios.

Risk Transfer Example #1: Commercial Property Owner and Tenant

Commercial property owners can face a variety of risks and challenges with their tenants. For example, after a business such as a small boutique enters a lease in a commercial property, the boutique owner may also sign a contract with the building owner. The contract should include wording to ensure the boutique owner keeps the storefront and the sidewalk immediately outside the shop

clean and free of snow or ice in the winter months . If a customer of the boutique slips and falls outside on ice, the contract will specify that the store owner would be responsible for the injured customer’s medical bills, or the legal costs should that customer sue. The contract would include a “Hold Harmless Agreement” that releases the commercial property owner from the consequences or liabilities due to the actions of the boutique owner.

Risk Transfer Example #2: Apartment and Security Company

Another scenario is an apartment complex manager hiring a security company to ensure the safety of the residents, perhaps due to several recent break-ins in the area. However, in this example, the security guard on duty neglected his post for a length of time, resulting in the robbery of one of the residents or a guest on the property. That individual may choose to sue the apartment complex for their injuries, stolen belongings or general pain and suffering the incident caused. Contractual risk transfer would have allowed the risk to shift to the security company – the party most able to control the risk.

Risk Transfer Example #3: Office Building and Janitorial Service Company

Janitorial service companies are hired by office building owners or managers to keep the premises clean and safe. Companies who provide these services should not only be thoroughly vetted before they are hired, but they should also sign a contract that would transfer some of the risks involved that may result in a high dollar claim. For instance, a janitor neglects to mop up a wet entrance after a particularly rainy day, and a guest in the building falls and breaks an arm. CRT would ensure the janitorial service company would be liable for the employee’s injuries and medical costs.

Another great example of risk transfer includes the general contractor and subcontractor relationship. General contractors hire subcontractors to handle specific jobs or projects. For instance, on a construction site, subcontractors complete projects like drywall, plumbing, electrical work, etc. Because these subcontractors have the most direct control over both the quality of the project and the safety of the workers involved, CRT helps shift the potential liability from the general contractor to the subcontractors.

General contractors should keep in mind that insufficient work performed by their subcontractor that results in property damage or bodily injury can result in a claim to the general contractor. This is true even if the subcontractor’s work was performed some time ago. With this in mind, all contracts between the general contractor and the subcontractor should have wording requiring that the subcontractor carry sufficient completed operations coverage.

How to Get Started with Contractual Risk Transfer

Contractual risk transfer is achieved in three foundational steps:

- Step 1: Assessing the risks and identifying opportunities for CRT.

- Step 2: Creating a written contract with your legal team’s counsel.

- Step 3: Vetting, contracting and maintaining COI recordkeeping processes.

First, it’s important to create a detailed list of the processes in your business, as well as a list of all the service providers, suppliers, vendors and subcontractors hired. Use this list to understand the specific risks your company could face should one of these parties not fulfill an obligation or make an error. This will help you identify where a high dollar claim could arise, and where there’s an opportunity to transfer risk.

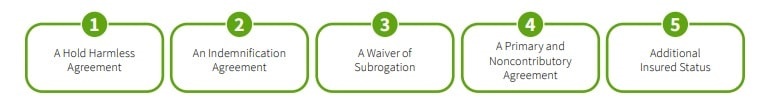

Always have your legal counsel review and update any contracts you’ve drafted with your service providers, suppliers, vendors and subcontractors. This contract should contain five crucial parts:

Finally, remember that CRT can only be effective if it is properly maintained and followed. Create a written checklist for your team to follow before moving forward with any new service provider, supplier, vendor or subcontractor. Thoroughly vet each new partner to learn about any risk management protocols they already have in place. Have them sign the CRT in writing, not simply verbally agree to it, before any work is completed. Keep proper records of each contract and other documentation in an organized file so you remember to request updates every year.

Loss Control Services from AmTrust Financial

AmTrust’s

Loss Control Department knows that access to the right

safety resources and commercial property safeguards are keys to a successful business. We can give you the individual attention you deserve, identifying specific hazards and offering recommendations that fit your operation. For more information, please

contact us today.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.

This material is for informational purposes only and is not legal or business advice. Neither AmTrust Financial Services, Inc. nor any of its subsidiaries or affiliates represents or warrants that the information contained herein is appropriate or suitable for any specific business or legal purpose. Readers seeking resolution of specific questions should consult their business and/or legal advisors. Coverages may vary by location. Contact your local RSM for more information.